Gloomy economic data published by the Bank of England has raised the spectre of “severe stresses” for UK businesses and a consequent credit crunch.

The Bank has warned that global financial markets are increasingly vulnerable to shocks following a “spike in volatility” over the summer.

In its latest Financial Policy Committee (FPC) report economists offered reassurance that the UK banking system remains robust enough to withstand tougher economic conditions and continue supporting households and businesses.

Nevertheless, there are choppy times ahead, particularly in vulnerable sectors.

While risks to UK financial stability have remained broadly unchanged since June, the FPC highlighted that uncertainty surrounding global geopolitics and economic forecasts remains elevated.

Tensions in the Middle East, in particular Israel’s ground offensives in Lebanon, have only added to the volatility.

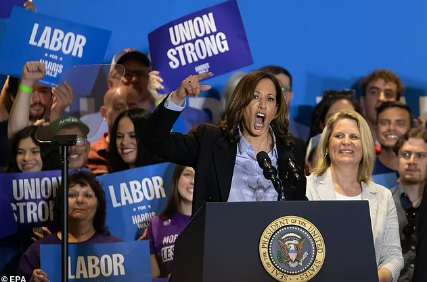

Chancellor Rachel Reeves has been warned of a possible incoming credit crunch (Image: GETTY)

The FPC noted a “short-lived spike in volatility and declines in global equity markets” in early August, driven by disappointing US employment data and underwhelming financial results from major technology companies.

Although positive macroeconomic news soon followed, prompting asset prices to return to “stretched” levels, the fragility of the markets remains a concern.

The report warned: “Markets remain susceptible to a sharp correction, which could affect the cost and availability of credit to UK households and businesses, with investors sensitive to short-term developments in a challenging global risk environment.”

Businesses and banks needed to be “prepared” for “severe but plausible stresses”, it added.

The Bank of England in Threadneedle Street (Image: Getty)

Despite the resilience shown by UK mortgage-holders, with home loan rates starting to fall, the FPC flagged ongoing pressure on lower-income households and renters.

Roughly a third of mortgage-holders have yet to refinance at higher interest rates, which could add further strain.

UK businesses, too, have demonstrated resilience, but the report stressed there are “pockets of vulnerability,” especially among private equity-backed firms and small and medium-sized enterprises (SMEs).

Insolvencies remain concentrated in sectors such as construction, retail, accommodation, and food services, where smaller businesses are facing increasing financial stress.

With the global risk environment intensifying, the FPC’s warning underlines the growing pressures that could soon manifest as severe challenges for UK businesses across several sectors – in effect a credit crunch.

The phrase, coined during the financial crisis of 2007/2008, refers to a situation where there is a significant reduction in the availability of loans or credit from banks and other financial institutions. This often occurs suddenly and can result from various factors, such as increased default risks, economic uncertainty, or a lack of liquidity in the banking system.

During a credit crunch, banks become more reluctant to lend, impose stricter borrowing conditions, or raise interest rates, making it difficult for businesses and individuals to access the funds they need.

This tightening of credit can slow down economic growth, as businesses may struggle to finance operations or expansion, and consumers may find it harder to borrow for major purchases such as homes or cars.

A credit crunch can also lead to financial instability, particularly in sectors that rely heavily on borrowing.