Budget fears mount as Cabinet minister claims Labour manifesto only promised to keep NICs on hold for workers… and bank chief warns over raid on pensions_Nhy

A Cabinet minister fueled Budget fears today as he insisted Labour only promised not to hike national insurance on employees.

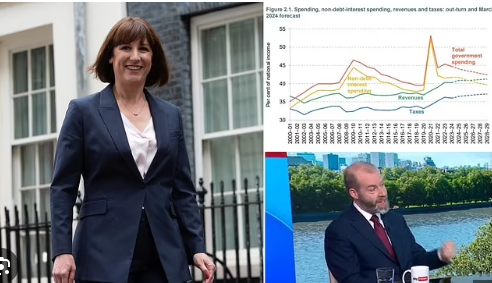

Business Secretary Jonathan Reynolds delivered a strong hint that the levy is set to be increased for firms as he said the manifesto ‘specifically’ protected workers.

Chancellor Rachel Reeves has warned of ‘pain’ for Brits in the package on October 30.

The respected IFS think-tank has warned that she could need to raise £24billion in tax to fund the government’s policies and avoid austerity.

Pushing NICS on employers’ pension contributions to the same level as those of workers – 13.8 per cent – could bring in £17billion a year.

However, Lloyds Bank chief executive Charlie Nunn warned this morning that anything that hit retirement funds would be ‘worrying’.

Speaking on Sky News, Mr Reynolds said of the manifesto vow on NICs: ‘It was taxes on working people, so it was specifically in the manifesto a reference to employees.’

Meanwhile, Ms Reeves used an article in the Sunday Times to give another indication that she is planning to loosen fiscal rules to borrow billions of pounds more – despite alarm at the UK’s debt mountain.

.

Business Secretary Jonathan Reynolds delivered a strong hint that the levy is set to be increased for firms as he said the manifesto ‘specifically’ protected workers

Chancellor Rachel Reeves has warned of ‘pain’ for Brits in the package on October 30

Lloyds Bank chief executive Charlie Nunn warned this morning that anything that hit retirement funds would be ‘worrying’

The Labour manifesto committed not to increase national insurance

Tax-free withdrawals from pension pots, inheritance tax and capital gains are also expected to be in the Chancellor’s crosshairs.

But there have been signs of growing anxiety within government over how to find the cash from already-struggling Brits.

As the Treasury heads into the ‘tunnel’ of wrangling with the OBR watchdog ahead of the fiscal package, few firm decisions are said to have been taken with jibes about ‘disarray’.

Rumours have been circulating that manifesto measures such as imposing VAT on private school fees and cracking down on non-doms will not bring in as much as hoped.

And having ruled out changes to headline income tax, VAT and national insurance rates, the Chancellor could be left relying on an array of smaller raids – the effects of which can be very hard to predict.

Mr Nunn was asked on the BBC’s Sunday with Laura Kuenssberg whether he would be ‘worried’ about tighter rules on pension investments or measures that could reduce how much people put in.

‘I think actually pensions, and contributions to pensions, is critical,’ he said.

‘We see about 40 per cent of people in the UK have a pension which won’t give them even a basic living allowance when they retire. So, we need to increase enrolment and investments in pensions.’

Shadow work and pensions secretary Mel Stride told Sky News’ Sunday Morning With Trevor Phillips that Labour ‘boxed themselves in’ by ‘claiming they were not going to be a party that was going to have to put up taxes’.

He said: ‘That leaves you with a narrow field of taxes now to go for.

‘I think if they go for employers’ national insurance, firstly, it’s a very bad tax to raise, because it’s a tax on jobs and what they should be about is growth and increasing productivity in the economy.

‘The second thing is, I think it goes totally counter to their manifesto that assured us they would not be putting up national insurance.

‘So unless they’re to argue that employers’ national insurance is not the same thing as national insurance, which is an absurdity to argue, then they’re going to be breaching their manifesto commitment.’

The Chancellor is said to be looking at increasing CGT from a typical level of 24 per cent to as high as 39 per cent.

The move could hit hundreds of thousands of people who already pay large amounts of tax to the exchequer, with the Guardian saying the internal modelling suggests it could bring in extra revenues of around a billion pounds.

However, going to the extreme end of the increase could actually leave income lower after five years.

Treasury sources rejected the accusations of chaos, while refusing to comment on details of tax plans ahead of the fiscal package.

The respected IFS think-tank has warned Ms Reeves needs to raise huge sums in the Budget