Rachel Reeves ‘plans to hike employers’ National Insurance by up to two percentage points in Budget to raise £20bn for public services’__Nhy

Rachel Reeves is set to increase employers’ national insurance contributions by up to two percentage points to collect billions to help fund the NHS.

Ahead of the upcoming budget on October 30, the Treasury is said to have already decided on upping the levy which could raise around £20billion.

Alongside this, the Chancellor is expected to lower the threshold for when employers start paying the tax.

Employers in the UK currently pay national insurance of 13.8 percent on a worker’s earnings above £175 a week.

The changes to employers’ national insurance contributions are set to be the single largest revenue raiser of next week’s Budget.

A government source said according to The Times: ‘There is a universal consensus that the NHS needs more money. That means asking businesses to help out.

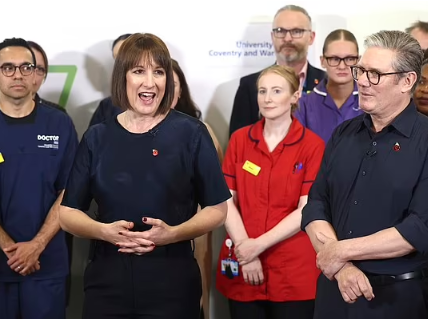

Rachel Reeves is set to increase employers’ national insurance by up to two percentage points to collect billions to help fund the NHS

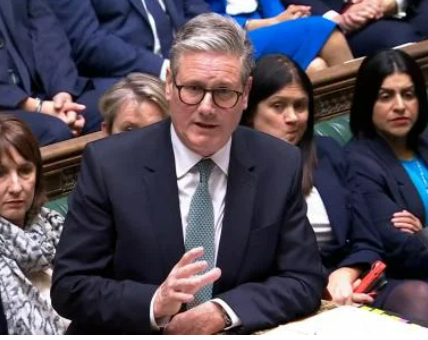

Prime Minister Sir Keir Starmer during a TV interview at the Commonwealth Heads of Government Meeting in Samoa on October 24

‘The choice is investment versus decline. She [Reeves] is choosing not to ask working people to pay the price for their [the Conservatives’] failures.’

However, business leaders have warned that the tax rises could lead to lower wages as employers try to cover their costs.

Currently a company with ten employees earning £35,000 each would pay £35,742-a year in employer national insurance.

However, if the rate was to increase by two per cent, this total would jump to £40,922 per year.

Speculation has been growing over the policies Labour will introduce in its first Budget in almost 15 years to fill a ‘£22billion hole’ in public finances.

In his manifesto, Sir Keir Starmer promised not increase taxes for ‘working people’ but has since been under pressure to define what he meant by the term.

In an interview with Sky News at the Commonwealth summit in Samoa, Sir Keir said a working person is somebody who ‘goes out and earns their living, usually paid in a sort of monthly cheque’ but they did not have the ability to ‘write a cheque to get out of difficulties’.

He and Ms Reeves were previously warned that increasing employers’ national insurance contributions would be a ‘straight forward breach’ of this pledge.

She is likely to argue, however, that it is not a breach as it will not directly affect employees.

Keir Starmer (pictured in Apia, Samoa) insisted next week’s fiscal package would ‘rebuild’ services and the economy

Ms Reeves also considered introducing national insurance employer pension contributions but is understood to have scrapped the idea.

Although this tax would raise an estimated £10billion, there are concerns it would leave people poorer in their retirement.

As well as increasing employee national insurance contributions, the government is also looking at upping levies on asset sales, such as shares and property.

There may also be changes to inheritance tax.

However, Sir Keir has insisted there is ‘no reason’ for entrepreneurs to leave the country.

He said: ‘My evidence that what we are saying is attractive to investors is last Monday’s investment summit that was hugely successful.

‘All the feedback back to us has been that it was very well received by a significant number of global investors.’

Sir Keir insisted people were investing in Britain ‘because of what this government is bringing to the table’.

Downing Street later said investors ‘shouldn’t be worried about this Budget’, despite some rushing to sell assets due to expected hikes in capital gains tax.