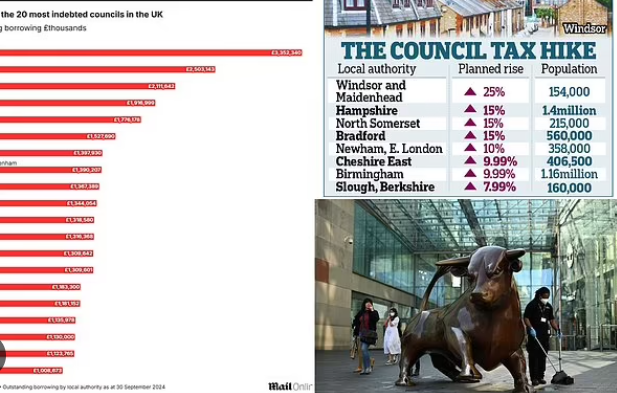

How far in the red is YOUR council? The town halls with up to £3.4BILLION of debt – as they plot to hike taxes for struggling residents_Nhy

UK councils are wilting under a mountain of debt, with the 20 most indebted councils owing more than £30billion.

Official figures show that UK local authorities had a total debt pile of more than £140billion last year.

It comes as more than four million people face punishing council tax rises above the maximum normally allowed by law.

Householders in one area could see their bills hiked by 25 per cent – the largest increase in England for two decades.

Seven other struggling councils around the country have proposed huge rises of between 9.99 and 15 per cent from April as they look to exploit a legal loophole, piling pressure on already under strain domestic finances.

Birmingham, which is one of the those councils, has the most outstanding borrowing, according to numbers released by the Ministry of Housing, Communities and Local Government (MHCLG).

The Labour-run authority, which effectively declared itself bankrupt in 2023, has a debt pile of £3.4billion, though the figures do not include liabilities that could increase them, like pension deficits or PFI contracts.

The second largest borrower is Leeds, another large Labour authority, with £2.5billion.

But third on the list is Woking, a small borough in Surrey which owes £2.1billion after a disastrous period of property speculation under its previous Conservative administration.

Find out how much outstanding debt your local councils have using the interactive table below.

Local authorities are permitted to raise council tax by up to 4.99 per cent under Government rules.