Imagine a world where paying for something was slow, clunky, and far from secure. It’s hard to picture today, where a quick swipe, dip, or tap is all it takes to complete a transaction. The credit card swiper, a seemingly simple device, has played a pivotal role in shaping our cashless society. Let’s take a journey through its history—from the early days of manual processing to the cutting-edge technology we rely on today.

Before the Swiper: A World of Knuckle-Busters and Carbon Copies

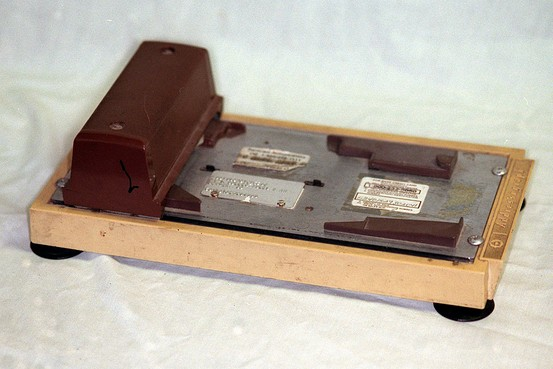

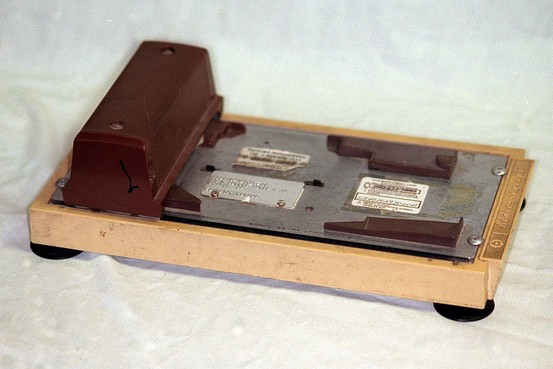

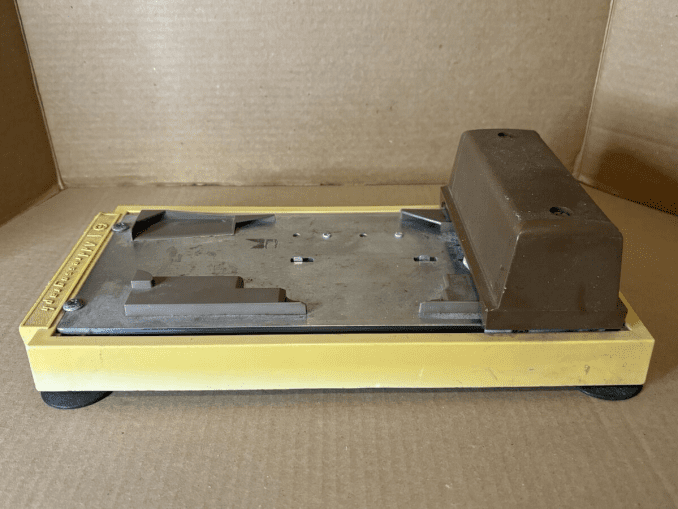

In the mid-20th century, credit cards were a game-changing innovation, but using them was far from seamless. Merchants relied on credit card imprinters, also known as “knuckle-busters.” These manual devices pressed card details onto carbon paper slips, requiring clerks to call for authorization.

The process was slow, prone to human error, and often left customers waiting uncomfortably. Worse still, the carbon slips exposed sensitive cardholder information, making fraud a constant concern. It was clear the system needed an overhaul.

The Invention of the Magnetic Stripe: A Turning Point

The late 1960s marked a breakthrough in payment technology with the invention of the magnetic stripe. This innovation, spearheaded by IBM engineer Forrest Parry, allowed critical cardholder data—like account numbers and expiration dates—to be encoded onto a strip of magnetic material.

Why the Magnetic Stripe Changed Everything

- Speed: Transactions became instantaneous as machines could now “read” the card’s data.

- Security: Encoding reduced the risks associated with manual entry and tampering.

- Global Standardization: The magnetic stripe quickly became a worldwide standard, enabling cross-border compatibility for banks and retailers.

The magnetic stripe laid the foundation for the first generation of credit card swipers, transforming the shopping experience for consumers and merchants alike.

The Birth of the Credit Card Swiper

By the 1970s, the credit card swiper was born, coinciding with the rise of electronic payment networks. These devices could read the magnetic stripe and send the data to payment processors for verification in seconds. For merchants, it meant fewer errors and faster transactions. For consumers, it meant convenience like never before.

How Early Swipers Worked

- The customer swiped their card through the reader.

- The swiper extracted encoded data from the magnetic stripe.

- The information was transmitted to the bank for authorization.

- Once approved, a receipt was generated for the customer to sign.

This new system was efficient, reliable, and set the stage for widespread credit card adoption.

The 1980s: Growing Pains and Public Embarrassment

The 1980s saw a surge in credit card use, but the system was far from perfect. Declined transactions weren’t just inconvenient—they were mortifying. Store clerks often had to call the bank for manual verification. If the card was deemed invalid, clerks had the authority to confiscate or even destroy it.

The Humiliation of a Declined Card

Picture this: A confident customer hands over their card, only to have it snipped in half with oversized scissors after a phone call to the bank. Such incidents underscored the need for more efficient and discreet ways to handle card issues.

From Swiping to Dipping: The Evolution of Payment Technology

As credit card use continued to grow, so did the need for more secure and advanced technology. The magnetic stripe, while revolutionary, was not without its vulnerabilities. Fraudsters developed techniques to skim data from the stripe, prompting a shift toward new systems.

The Introduction of EMV Chip Technology

By the early 2000s, the industry adopted EMV (Europay, Mastercard, Visa) chip technology. Unlike magnetic stripes, EMV chips generate a unique transaction code for every purchase, making it nearly impossible for fraudsters to replicate.

- Dipping Instead of Swiping: Chip-enabled swipers allowed users to insert their cards, adding an extra layer of security.

- Global Adoption: EMV technology became a global standard, much like the magnetic stripe decades earlier.

Contactless Payments: The Swipe Reinvented

Today, credit card swipers have evolved to include contactless payment options using NFC (Near-Field Communication) technology. Customers can simply tap their cards or smartphones on the reader to complete transactions in seconds.

Why Contactless Payments Matter

- Speed: Transactions are faster than ever.

- Hygiene: Contactless options gained significant traction during the COVID-19 pandemic, reducing the need for physical contact.

- Convenience: From smartphones to smartwatches, multiple devices can now act as payment tools.

The Rise of Mobile Card Readers

One of the most significant advancements in credit card technology has been the advent of mobile card readers. Companies like Square and PayPal introduced compact swipers that connect to smartphones or tablets, making it easier for small businesses and freelancers to accept payments.

Benefits of Mobile Readers

- Accessibility: Entrepreneurs no longer need expensive point-of-sale systems.

- Portability: Vendors at markets, fairs, and pop-up shops can process payments on the go.

- Affordability: Mobile readers are cost-effective, enabling even the smallest businesses to thrive in a cashless economy.

Cultural Significance: The Swipe as a Symbol of Convenience

The act of swiping a credit card has become so ingrained in our daily lives that it’s easy to overlook its cultural impact. The iconic swipe represents more than just a transaction—it symbolizes convenience, innovation, and progress.

Even as chip readers and digital wallets become more prevalent, the swipe remains a nostalgic gesture for many. That familiar motion and the sound of a card sliding through a reader evoke memories of simpler times in the ever-evolving world of commerce.

Conclusion: The Lasting Legacy of the Credit Card Swiper

The credit card swiper may seem like a modest device, but its influence on global commerce is profound. It bridged the gap between manual transactions and electronic payments, paving the way for the cashless society we enjoy today. Over the decades, it has evolved to meet new challenges, from the introduction of EMV chips to the rise of contactless and mobile payments.

As technology continues to advance, the role of the swiper will undoubtedly change. However, its legacy as a catalyst for innovation and convenience will endure. Next time you swipe, dip, or tap, take a moment to appreciate the journey of this humble yet revolutionary tool—one that has forever changed the way we pay.