Bank of England CUTS interest rates to 4.5% in bid to revive economy – as it HALVES growth prediction for this year after Labour’s disastrous Budget_Nhy

The Bank of England cut interest rates today as it bids to revive the stalling economy and warned of mounting ‘uncertainty’ around the world.

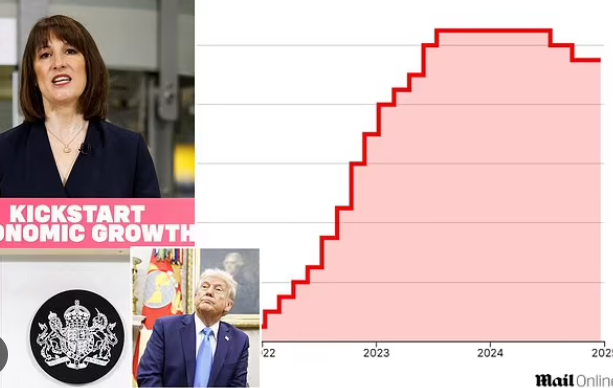

The Monetary Policy Committee voted by 7-2 to reduce the level from 4.75 per cent to 4.5 per cent.

That is the lowest point in more than 18 months – giving mortgage-payers much-needed breathing space.

Two members wanted a bigger 0.5 percentage point reduction, underlining the extent of alarm about the economic slowdown in the UK after Rachel Reeves’ huge Budget tax raid.

The Bank said inflation has eased more slowly than hoped, and will increase ‘materially’ in the first half of this year – with energy costs, water bill surge and the national insurance rise blamed.

In a dramatic shift, growth forecasts have been halved for this year from 1.5 per cent to 0.75 per cent, although it is due to pick up later.

The Treasury’s OBR watchdog pencilled in a figure of 2 per cent at the time of the Budget in October.

The need to kickstart activity has outweighed fears that Donald Trump’s trade tariffs will put upwards pressure on inflation – something Threadneedle Street uses interest rates to counter.

Keir Starmer and the Chancellor put a brave face on the news, as they scramble to find policies that can drive growth.

The PM said people would have ‘more money in their pockets’.

But businesses have warned they face cutting jobs and pushing up prices after her national insurance hike.

There are also concerns that stuttering growth means Ms Reeves will have to increase the burden again or cut public spending to balance the books in the coming months.

The FTSE 100 hit a new record high on the announcement, while the Pound fell sharply against the dollar as markets priced in more cuts to come.

The Bank’s updated forecasts suggest that inflation is easing more slowly than hoped, and growth has been ‘weaker than expected’

Inflation is due to hit 3.7 per cent this summer before subsiding again

Chancellor Rachel Reeves (pictured) has been scrambling to find policies that can drive growth, but businesses have warned they face cutting jobs and pushing up prices after her national insurance hike