Chancellor Rachel Reeves is warned not to slash the 25% tax-free lump sum pensioners can access from their pots when they retire amid fears plan could be subject to a LEGAL challenge

Rachel Reeves has been warned against raiding pensioners’ tax-free lump sums to try to balance the books.

Under current rules, most savers can take 25 per cent of their pension pot tax free once they reach the age of 55, up to a maximum of £268,275.

Officials are considering slashing the amount to £100,000 in a bid to raise around £2 billion in revenue at the Budget.

But yesterday experts warned the Chancellor against slashing the tax-free lump sum.

Sir Steve Webb, a former pensions minister and now a partner at pension consultants LCP, said he did not think it was a sensible way to raise money.

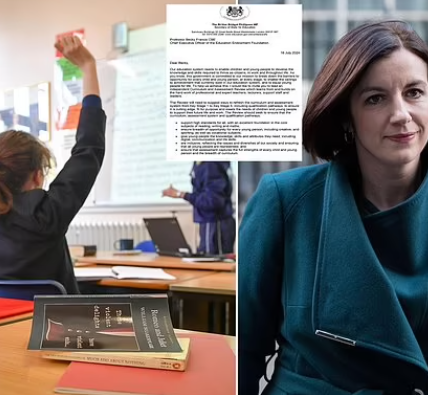

Chancellor Rachel Reeves (pictured at Labour conference last month) has been warned by experts against slashing the tax-free lump sum

Treasury officials are considering slashing the amount to £100,000 in a bid to raise around £2 billion (file image)

‘One of the problems obviously is that there are a bunch of people who have planned on the basis that they will be able to take these lump sums, and quite a few people will be over these limits already,’ he told BBC Radio 4’s Today programme.

‘So if you brought in a change like this, you would have to have lots of complicated transitional rules and that in turn means you wouldn’t raise very much money for quite a long time.

‘So I’m sure it is being looked at, but actually I would be very surprised if it went ahead.’

Mike Ambery, of the pension firm Standard Life, told the Daily Telegraph: ‘Operationally, it would be complicated.

‘That’s because pension funds are normally written under trust and also you can’t really retrospectively make changes to benefits that people have already built up.

‘It could be subject to a legal challenge.’

SEE MORE :

Fears grow that lenders may start to raise mortgage rates if Rachel Reeves fiddles with Britain’s debt figures

Mortgage rates could rise again in the coming weeks, delivering a fresh blow to homeowners if Rachel Reeves fiddles with Britain’s debt figures.

Falls in mortgage rates are expected to come to an ‘abrupt halt’ this week as lenders reassess the risk of a rising cost of borrowing following the Chancellor’s Budget on October 30 and growing tensions in the Middle East.

Concern from global investors that Labour will fund investment with higher debt has begun to spook lenders.

Ms Reeves has signalled she will push ahead with plans to borrow money to invest in infrastructure despite the rising cost of government debt.

Smaller banks and building societies have already started to hike their rates, with Coventry Building Society increasing rates from tomorrow.

Concern from global investors that Labour will fund investment with higher debt has begun to spook lenders (pictured: Chancellor Rachel Reeves)

Lenders had been slashing mortgage rates since the Bank of England cut interest rates in August (file photo)

Specialist lenders Keystone and Aldermore announced rate increases and axed certain deals earlier this week, while the Co-operative Bank will withdraw some of its most generous rates tonight.

This could dash the hopes of hundreds of thousands of homeowners with fixed-rate deals due to end in the final few months of the year who were hoping to roll on to lower rates.

Lenders had been slashing mortgage rates since the Bank of England cut interest rates in August.

The current base rate is 5 per cent, after months at 5.25 per cent — which was the highest level for 16 years.

Borrowing costs have also been pushed higher by suggestions the Bank of England will cut interest rates only slowly.

Brokers have warned that more lenders could begin to push rates higher once again over the coming weeks.

David Hollingworth, of broker L&C Mortgages, said: ‘The mortgage market has seen rates falling in recent months but that may be coming to an abrupt halt.

‘Fixed-rate pricing depends on what the market anticipates may happen to interest rates and uncertainty over the forthcoming Budget, mixed messages from the Bank of England and global unrest is pushing costs back up for lenders.’

Swap rates — which are used by lenders to manage interest rate risk and price mortgage deals — have ticked upwards.

Mark Scott, of Positive Advisers, said: ‘It may get a lot worse before it settles down again if Rachel Reeves spooks the market with planned changes to the government borrowing rules.

‘Mainstream lenders will have to price upwards to follow those lenders more dependent on the wholesale money markets.’

Brokers are urging prospective buyers and remortgaging homeowners to secure a rate now.