Here comes the council tax pain! Average bills are set to soar by an inflation-busting 5% this year – so how much more will YOU be paying?_Nhy

Struggling households are facing inflation-busting council tax rises next month – with the overwhelming majority imposing the maximum allowed.

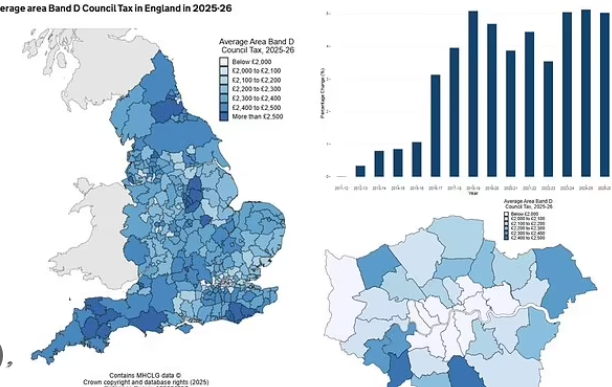

Average bills are set to soar 5 per cent in the coming year, with the typical Band D cost in England up £109 to £2,280.

Of the 384 authorities covered by the government’s cap – set at 4.99 per cent apart from a few in dire circumstances – 293 are imposing as much as they were allowed.

Another 56 are ‘close’ to the ceiling, according to official figures released today. Just eight either froze or cut their Band D charge.

However, despite the eye-watering extra costs for families, councils have already been warning that they will struggle to make ends meet due to pressure on services.

The statistics emerged as the local elections battle kicked off in earnest, with the Tories launching their campaign.

The government figures showed that In 2025-26, 147 adult social care authorities are imposing the highest increase permitted for the element at 2 per cent.

Average bills are set to soar 5 per cent in the coming year, with the typical Band D cost in England up £109 to £2,280

The 5 per cent increase is above inflation and comes after a series of eye-watering hikes

That accounts for £34 of the rise in the average Band D council tax bill across England.

The average area Band D council tax will be £1,982 across London – up £89 or 4.7 per cent.

But that compared to £2,289 in metropolitan areas, a hike of £121 or 5.6 per cent.

For unitaries the level will be £2,366 – up 5.2 per cent – and in shires £2,344, a 4.8 per cent rise.

Across England the average council tax per dwelling will be £1,770 in 2025-26.

Average area band D council tax ranges from £998 in Wandsworth, south London, to £2,671 in Rutland, with 73 per cent of authorities having an area average band D between £2,200 and £2,500.

Shadow communities secretary Kevin Hollinrake said: This Labour government is driving up costs for councils across the country with their jobs tax.

‘It’s no surprise they have raised council tax by 5 per cent, with the highest increases by Labour and Liberal Democrat councils.

‘We are the only ones standing up to a dreadful Labour government determined to crush businesses, raise your taxes and trash the economy.

‘This has been engineered by Labour, who have left town halls to foot the blame when records bills fit the doormat.’

A Ministry of Housing, Communities and Local Government spokeswoman said: ‘We are under no illusion about the scale of financial issues facing councils we inherited and our work is underway to fix the foundations and bring long-term stability to the sector.

‘And while councils are ultimately responsible for setting their own council tax levels, we have been clear that they should put taxpayers first and carefully consider the impact of their decisions.

‘That’s why we are maintaining a referendum threshold on council tax rises, so taxpayers can have the final say and be protected from excessive increases.’

Elliot Keck, head of campaigns of the TaxPayers’ Alliance, said: ‘Fresh government data on council tax rises shows that once again local authorities across the country have failed in the desperate need to drive up standards.

‘The fact that so few have not used the maximum increase available demonstrates that the stagnant productivity that is driving up costs is endemic in local government, forcing councils to reach deeper into the pockets of local taxpayers just to stand still.

‘Town halls across England need to spend the next financial year imposing rigorous key performance indicators and performance reviews for all staff to ensure there is no one failing to pull their weight.’

Cllr Barry Lewis, Finance Spokesperson for the County Councils Network, said residents in their areas were paying ‘significantly more than people living in large towns and cities’.

‘This year, some of those urban councils are in a position to freeze council tax or scale back service reductions due to the government focusing funding on these places at the expense of county areas,’ he said.

Council tax is lower in London than in many over parts of the country – and rises in the capital is set to be smaller than the average for England

‘Councils in county areas have lost more central government funding over the past two decades than other parts of the country, leaving them more reliant on council tax to fund vital services such as adult social care, pothole repairs, libraries, and special educational needs.

‘This is despite councils in county areas seeing demand and costs for adult social care and children’s social care rise more than any other part of England, and this is projected to continue during the course of this Parliament.

‘The government is set to permanently update the distribution of funding to councils in its forthcoming ‘fair funding review’.

‘But if funds are focused heavily on urban areas – despite little evidence to support this – then it will widen this gap even further, leaving counties even more reliant on their local taxpayers to fund their services.’