IFS predicts Labour will be forced to hike taxes AGAIN to avoid austerity – despite burden hitting record high and UK’s revenues being set to overtake rivals after huge Budget raid_Nhy

Labour faces being forced to hike taxes again to avoid austerity, a respected think-tank warned today.

The IFS insisted dismal growth would make further increases to the burden ‘difficult to avoid’ for Chancellor Rachel Reeves.

The grim assessment came in a report highlighting that taxes are already heading for a record high after the huge Budget raid.

Government revenues as a proportion of national income are also set to overtake the average for rival economies.

However, the IFS pointed out that other states had been increasing taxes, and Britain’s revenues had been ‘catching up’ since the mid-1990s after being cut under Margaret Thatcher.

The IFS highlighted in a report that taxes are already heading for a record high after the huge Budget raid. The IMF figures do not yet cover those increases

The IFS insisted dismal growth would make further increases to the burden ‘difficult to avoid’ for Chancellor Rachel Reeves

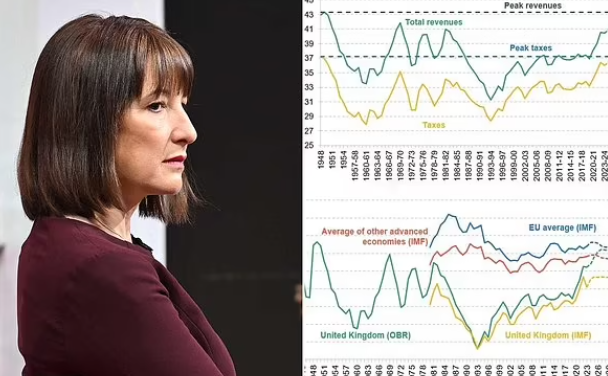

Revenue from taxes are heading for new post-war record highs. However, overall revenues are slightly below record levels as non-tax incomes from elements such as interest, dividends and profits from state-owned enterprises have not recovered

The analysis said the tax rises in the October fiscal package, on top of increases during the last Parliament, will take revenues to record highs.

‘Government revenues have been on the rise in many advanced economies recently, with many countries approaching – or being at – their record-high levels,’ the report said.

‘Revenues in the UK fell well below the average of its peers over the 1980s but have been catching up since then.

‘With the latest tax rises announced in the October 2024 Budget, total revenues in the UK are forecast by the OBR to exceed the average of other advanced countries and reach near-record levels seen just after the Second World War.’

The IFS said that part of the issue was the UK government income from non-tax elements – such as interest, dividends and profits from state-owned enterprises – had not recovered in the last 40 years.

The think-tank said: ‘For a Chancellor committed to keeping debt from rising and avoiding a ‘return to austerity’ in the form of cuts to spending on public services then, absent stronger growth, further tax rises may prove difficult to avoid.’

Martin Mikloš, a research economist who co-authored the report, said: ‘UK Government revenues are approaching a record high.

The IFS said many countries were seeing government revenues above the long-term average

‘But the UK is not alone in this: many other advanced economies have pushed their tax take to near-record levels in recent years.

‘Having fallen during the 1980s UK revenues have been rising since the mid-1990s. On the latest forecasts from the Office for Budget Responsibility revenues in the UK will soon rise slightly above the average of our peers.

‘Given that our appetite for public spending appears to have already matched that of other countries, we should not be surprised if we need to tax as much too.’