Keir Starmer and Rachel Reeves dodge pain of energy and water hikes thanks to ‘cap’ on bills at Downing Street flats… as they enjoy Westminster’s low council tax_Nhy

Keir Starmer and Rachel Reeves are escaping some of the April bills pain being inflicted on Brits.

The PM and Chancellor only pay a taxable benefit on running costs at the grace-and-favour apartments in Downing Street.

That is capped at 10 per cent of their ministerial salaries – meaning they contribute around £3,000 to cover all utilities and other expenses, and the sum will not go up.

Sir Keir, who earns £169,000 as PM and an MP, and Ms Reeves – paid around £161,000 – also benefit from some of the lowest council tax rates in the country in Westminster.

The Band H charge for the Downing Street residences is £2,034 in 2025-26. That is lower than the Band D average for England, and compares to more than £5,000 in Rutland.

Sir Keir and Ms Reeves also have chauffeur-driven cars, limiting their exposure to increases in vehicle excise duty.

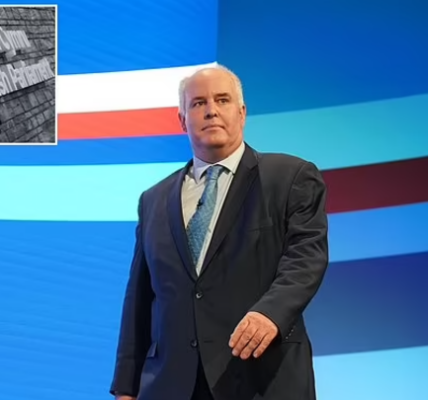

Keir Starmer (pictured) and Rachel Reeves are set to be insulated from the impact of energy and water bill hikes

The PM and Chancellor (pictured) only pay a taxable benefit on running costs at the grace-and-favour apartments – capped at 10 per cent of their ministerial salaries.

The Treasury’s accounts set out that the PM and Chancellor have a tax liability for expenses relating to the use of their official apartments, such as heating and lighting

The annual energy bill for a household on a variable tariff – as opposed to a fixed deal – using a typical amount of gas and electricity will go up by 6.4 per cent or an average £111 a year to £1,849 from today

The boon for Labour’s top politicians has been highlighted as Brits are hammered with a bewildering array of cost increases.

The annual energy bill for a household on a variable tariff – as opposed to a fixed deal – using a typical amount of gas and electricity will go up by 6.4 per cent or an average £111 a year to £1,849 from today.

Regulator Ofgem said it has increased the cap in response to a recent surge in wholesale prices.

The limit is set every three months and limits the amount suppliers can charge for each unit of gas and electricity, but not the total bill, so if you use more, you will pay more.

It affects 22million homes in England, Wales and Scotland.

Standing charges – daily fixed fees to connect to a gas and electricity supply which vary by region – are rising again for gas but dropping for electricity, although it depends on where you live.

Households in England and Wales will see their water bills increase by an ‘extortionate’ average of £86 next year alone, as firms face accusations of years of under-investment in their crumbling infrastructure.

Regulator Ofwat has allowed companies to raise average bills by £31 a year, or £157 in total, over the next five years to £597 by 2030 to help finance a £104 billion upgrade for the sector.

That represents a 36 per cent increase before inflation, which will be added on top.

Households will even harder hit from April with an average increase of £86 or 20 per cent front-loaded into the coming year, followed by smaller percentage increases in each of the next four years.

Homes across England face paying an average of £2,280 after almost all town halls raised the tax by the maximum 5 per cent allowed.

It means rates for a standard Band D property have soared by 20 per cent in just five years.

On a visit to a business this morning, Sir Keir acknowledged rising bills were putting pressure on household finances but insisted wage increases would leave people better off.

He told Sky News: ‘I think for most people, they would say the cost-of-living crisis is ongoing, and they feel the pressure financially.

‘That’s why it’s so important we make good on our pledge that people would feel better off and the national living wage going up today by an average of £1,400 is going to affect millions of people, so in their pay packet this month, and obviously for months to come, they will now be getting more money.

‘That’s alongside the other work we’ve done – interest rates have been cut three times since we’ve had a Labour government, so anybody with a mortgage knows that the rates are coming down, and of course, on average, wages going up now more quickly than prices.

‘I acknowledge that with bills coming in, people see that rise and that is a pressure. That is why it’s so important we deliver on the national living wage, to make sure people are better off – £1,400, quite a significant amount of money for millions of workers.

‘Making sure that interest rates are coming down not going up, that makes a big difference, wages going up higher than prices.’

Sir Keir is living with his wife Victoria and their two children in the larger flat above No11, while Ms Reeves and her family are above No10.

Downing Street has previously argued it is impossible to separate costs for the flats from the wider ones of running offices and kitchens.

Under government rules, the PM and Chancellor have a tax liability for expenses ‘relating to the use’ of their official apartments, such as heating and lighting.

The value of the benefit is capped at 10 per cent of their ministerial salaries – so not including their MP pay.

The actual cost to them will depend on their total taxable income, but is likely to be between £3,000 and £3,300.

Crucially the energy and water bills for Sir Keir and Ms Reeves will not change despite the energy price cap rising for the rest of the country.

While fuel duty may have been frozen again at the Budget, drivers of new petrol, diesel and hybrid vehicles are set to face higher first-year tax rates from April.

In an attempt to drive consumers towards electric vehicles while widening the gap between ‘higher polluting’ vehicles and EVs, the Government will be increasing the first-year Vehicle Excise Duty (VED) for many new cars.

A car’s first-year tax figure is calculated by taking into account the amount of CO2 it produces. At present, electric vehicles don’t incur any VED charges, while cars emitting between 111g and 150g/km pay £220. Those that emit more than 255g/km pay £2,745 for their first year.

However, buyers of electric vehicles are set to pay £10 for their first year’s VED from April, under a change introduced by the previous Tory administration.

EVs will then be subject to the standard rate of £195 for every subsequent year of ownership.