Keir Starmer desperately dodges at PMQs over fears of £17BILLION national insurance hit to pension contributions in Budget – as Tories accuse him of ‘fiddling’ borrowing figures

Keir Starmer desperately dodged today as he was challenged to rule out a massive national insurance raid at the Budget.

Sir Keir floundered as Rishi Sunak repeatedly pressed him at PMQs on speculation that the levy could be extended to employers’ contributions.

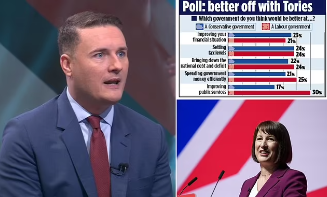

Imposing the measure on pension contributions alone could raise up to £17billion for Chancellor Rachel Reeves as she desperately tries to balance the books after bumper public sector pay deals.

But there have been warnings it would hammer pension pots and undermine efforts to shore up poorer workers’ savings with auto-enrollment.

During the first clash since party conferences, Mr Sunak asked the premier whether his vow not to increase NICs extended to employer pension contributions.

But Sir Keir merely said he would not talk about the Budget, and swiped that Mr Sunak was the ‘expert’s expert on raising taxes’.

In other developments as the fiscal package looms on October 30:

- Ms Reeves could sign off an ‘HS2 light’ project running from Birmingham to Manchester as she loosens government borrowing rules;

- Mr Sunak also voiced alarm that Ms Reeves is planning to ‘fiddle’ debt rules to allow tens of billions more borrowing;

- Campaigners have warned that axing the 5p reduction on fuel duty will leave pump prices close to post-Covid highs.

Keir Starmer desperately dodged today as he was challenged to rule out a massive national insurance raid at the Budget

Sir Keir floundered as Rishi Sunak repeatedly pressed him at PMQs on speculation that the levy could be extended to employers’ contributions

Challenged again, the PM said: ‘We are here to stabilise the economy and we will do so.’

Currently, employers pay NICs at 13.8 per cent on workers’ wages above £9,100 a year.

But firms do not pay any National Insurance on money they pay into pensions on behalf of their staff.

The Institute for Fiscal Studies has suggested the rule ‘should be reformed’, calculating that if employers were charged NI on pension contributions at the same rate as wages – 13.8 per cent – it could raise £17billion a year.

Tom Selby, director of public policy at stockbroker AJ Bell, said: ‘This seems the most straightforward way to raise cash quickly if the Government wants to raise money from pensions. It wouldn’t be a surprise.’

However, Mr Selby said he would expect there to be a reduced tax rate on employer contributions, rather than the full 13.8 per cent tax charge.

Mr Sunak told MPs: ‘When (Sir Keir) talks about security at work, once again, it’s one rule for him and another rule for everyone else.

‘But I know that not everything or everyone has survived his first 100 days in Government, so can he confirm that when he promised not to raise income tax, National Insurance or VAT, that commitment applies to both employer and employee National Insurance contributions?’

The Prime Minister replied: ‘We made an absolute commitment in relation to not raising tax on working people.

‘He, of course, was the expert’s expert on raising taxes. What did we get in return for it? We got a broken economy, broken public services, and a £22 billion black hole in the economy. We’re here to stabilise the economy, and we will do so.’

Mr Sunak quipped that he did not think even Labour donor Lord Waheed Alli was ‘buying any of that nonsense’.

‘I’m not asking about the Budget, I’m asking specifically about the promise he made the British people,’ he said.

‘So let me ask him again, just to clarify his own promise. Does his commitment not to raise National Assurance apply to both employee and employer National Insurance contributions?’

Sir Keir replied: ‘We set out our promises in the manifesto. We were returned with a huge majority to change the country for the better, and I stick to my promises in the manifesto.’

Turning to rumours of changes to the borrowing rules, Mr Sunak said: ‘Before the election his Chancellor said changing the debt target in the fiscal rules would be tantamount to fiddling the figures.

The UK’s debt pile has reached the same size as the entire economy for the first time since 1961, according to official figures

‘Does he still agree with the Chancellor?’

The PM replied: ‘This is literally the man who was in charge of the economy, 14 years they’ve crashed the economy. What did they leave? A £22billion black hole in the economy.

‘Unlike them we won’t walk past it. We will fix it. And it’s only because we are stabilising the economy that we are getting the investment into this country. But I still notice he has hasn’t talked about that investment.

‘We are powering ahead with clean British energy, we are changing the rules to build 1.5 million homes and returning railways to public ownership, and they’ve got nothing to say about any of this.’

Asked after the clashes whether the commitment on national insurance includes employers’ contributions, the PM’s official spokesman said: ‘When it comes to the budget, the priority is going to be about fixing the foundations of the economy, fixing economic stability, boosting investment and delivering reform.

‘When it comes to taxes, I have nothing to add beyond what is in the manifesto which is that we will ensure taxes on working people are kept as low as possible, and that we will not increase taxes on working people, which is why we will not increase national insurance, income tax or VAT.’

He added: ‘The budget is obviously three weeks today and I can confidently predict that there’ll be many questions in advance of the budget that we will not be able to provide specific answers to and you will have to wait for the budget itself to provide those details.

‘But as I say, the manifesto commitment remains that we will not increase taxes on working people.’