Labour’s economic nightmare before Christmas as shoppers close their wallets: Retailers blame the Budget as sales fall for the third month in a row while families wait for bargains_Nhy

Labour’s Budget is being blamed for a sluggish Christmas shopping period as shops struggle to get hard-pressed families to part with their cash.

The Confederation of Business Industry (CBI) today said retailers were enduring ‘a gloomy festive period’ with a fall in year-on-year sales in December to date.

It is the third month in a row its distributive trades survey has found year-on-year sales below 2023 levels.

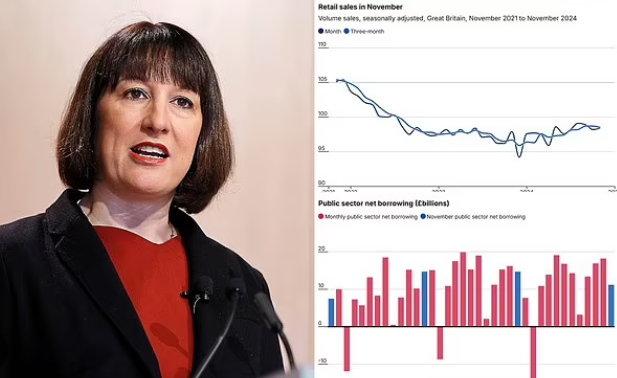

And it comes as wider retail sales figures for November released by the Office for National Statistics today showed sluggish growth.

Food sales underpinned a 0.2 per cent rise in business, lower than the 0.5 per cent rebound forecast by economist, after retail sales fell 0.5 per cent in October.

Among the areas badly hit were clothes and shoe sales, which were down 2.6 per cent.

The ONS also found that online sales were down across the board in November, though its figures did not cover the Black Friday period at the end of the month.

Chancellor Rachel Reeves is facing pressure after a new forecast by the Bank of England last night downgraded its UK growth outlook for the last three months of this year to zero, from a previous prediction of 0.3 per cent.

It came after the Bank yesterday held interest rates in the wake of a surge in inflation, raising fears that the country may be heading into recession.

Writing for MailOnline the Chancellor warned the public sector ‘the answer cannot always be more money’ after a wave of above-inflation pay rises for medics and train drivers.

Martin Sartorius, the CBI’s principal economist, said: ‘Retailers have endured a gloomy festive period, with annual sales declining for a third consecutive month. Looking ahead, retailers expect sales to fall again in January, while wholesalers and motor traders are braced for sharper sales declines.

‘Firms across the distribution sector will be glad to see the end of a difficult 2024, but the new year is not set to bring relief. Measures announced in the Budget will push up businesses’ employment costs, and consumer spending is expected to remain modest as incomes growth slows.

‘The Government can take steps to support firms’ confidence by implementing a faster, more transformative timetable for business rates reform and developing a long-term, modern industrial strategy to unlock innovation, attract investment and drive sustainable economic growth.’

Ms Reeves today vowed to keep public finances under a tight rein.

Writing for MailOnline the Chancellor warned the public sector ‘the answer cannot always be more money’ after a wave of above-inflation pay rises for medics and train drivers, and for the NHS.

Her position has been boosted by better-than expected borrowing figures this morning.

Government borrowing fell to £11.2 billion last month, the lowest November figure in three years.

It was £3.4 billion lower than the same month last year as tax receipts rose and debt-interest payments fell sharply, the ONS said.

Economists had predicted £13.3 billion of borrowing for November.

While departmental spending, welfare payments and other public services spending rose, the fall in the cost of servicing the national debt was enough to bring down the overall borrowing figure.

British retailers returned to growth last month, up 0.2 per cent, with supermarket pre-Christmas sales offsetting the weakest trading for clothing stores in almost three years.

The ONS said this came after clothing and footwear retailers reported that sales volumes dropped by 2.6 per cent for the month, taking them down to the lowest monthly level since January 2022.

However, this was largely offset by a 0.5 per cent rise in sales across food and drink retailers, driven by major supermarkets.

Household goods retailers also had a stronger month, with sales rising by 1.1 per cent in November on the back of significant improvement among furniture stores.

Elsewhere, online retail sales slipped for the second month in a row despite discounting ahead of Black Friday.

In her article Ms Reeves admitted that families were struggling with high costs but insisted the government was making ‘progress’ in ensuring people feel better off.

And addressing the public sector she said: ‘The answer cannot always be more money. That means not easing open the purse strings on government spending.

‘We must first look at what can be done better. Faster. Or perhaps whether it needs to be done at all.’

Earlier this month angry trade union bosses warned of fresh NHS and school strikes after ministers recommended a 2.8 per cent pay rise for millions of public sector workers.

In its submissions to a series of pay review bodies, the Government set out its proposed limit for salary increases for 2025/26.

This included for teachers, NHS staff and senior civil servants, who were among public sector workers already given pay rises of between 4.75 per cent and 6 per cent this year.

Shadow business secretary Andrew Griffith last night said: ‘Today’s growth downgrade from the Bank of England follows warnings from almost every business group and forecaster.

‘Rachel Reeves has no feel for how to run an economy, instead she has already killed jobs, investment and growth on her watch.’

Sir Keir Starmer last night appealed to the public to be patient on Labour’s promise to turn round the economy.

The Prime Minister told MPs it ‘will take some time’ for people to feel the benefit of the Budget and other measures brought in by the new government.

Paul Dales, chief UK economist at consultancy Capital Economics, said: ‘The forecast gives more credence to the idea that the economy is flirting with recession.’

And shadow chancellor Mel Stride warned it may mean Ms Reeves will have to break her pledge not to come back for more tax hikes to finance her spending plans.

There are also fears that even as growth stagnates, inflation could climb – creating a worrying 1970s-style ‘stagflation’ scenario.

Worries about inflation – already at an eight-month high – prompted the Bank’s nine-member Monetary Policy Committee (MPC) to leave interest rates on hold at 4.75 per cent yesterday.

It was a blow to millions of borrowers who might have hoped that rates would be falling more sharply by now.

Mail readers will know when we’ve won. Their living standards will be higher. And they WILL feel better off, says Chancellor Rachel Reeves

I know families are still struggling with high costs. We want to put more money in the pockets of working people, but that is only possible if inflation is stable and I fully back the Bank of England to achieve that.

I know that this week’s inflation statistics was not the news families want to read after years of battling with the cost of living.

That’s why I never stopped fighting to put more money into people’s pockets.

In my Budget I made sure payslips were protected from tax rises. I froze fuel duty to save people money at the pump. And three million people on the National Living Wage will get £1,400 more per year from April.

I know that this week’s inflation statistics was not the news families want to read after years of battling with the cost of living .

Mail readers will know when we’ve won. Their living standards will be higher. And they will feel better off. That’s not today. But it is the path we’re on.

Earlier this week we saw that real wages have grown at their fastest rate in three years.

That’s worth an extra £20 a week into people’s pockets after inflation.

And the average two year fixed mortgage rate is now about half a percentage point lower than it was at the election.

That is progress made. But I’m not taking it for granted.

I am staying in the fight. The answer cannot always be more money. That means not easing open the purse strings on government spending.

We must first look at what can be done better. Faster. Or perhaps whether it needs to be done at all.

That means going for growth as our number one mission. Attracting investment from around the world. And creating stability for businesses to succeed.

Mail readers will know when we’ve won. Their living standards will be higher. And they will feel better off.

That’s not today. But it is the path we’re on.