Nearly HALF of Brits who haven’t retired – 25m people – live in households that get more from the state than they pay in taxes_Nhy

Nearly half of Brits who have not retired live in households that get more from the state than they pay in taxes.

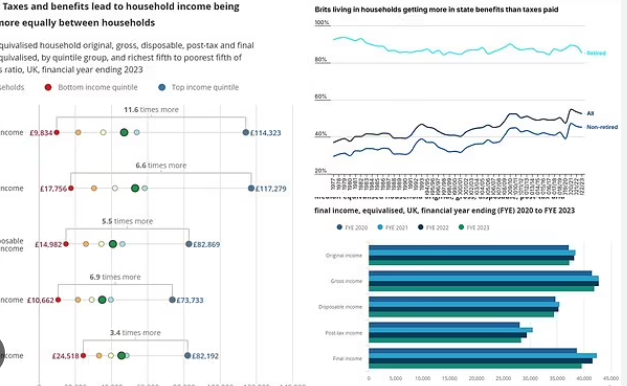

Some 45.3 per cent – around 25million people – were classified as net beneficiaries in 2022-23, the latest year available.

That was up from under 32 per cent at the turn of the century.

Including the 85.3 per cent who had retired and likely getting the state pension, 52.6 per cent were in households that received more than they contributed.

The striking numbers will raise fresh concerns about the sustainability of the public sector, with tax surging towards a record high after Labour’s Budget raid.

The Office for National Statistics calculation covers handouts for unemployment or illness – but also ‘benefits in kind’ such as education and childcare.

The ONS figures showed the median equivalised household income before taxes and benefits was £37,300 in 2022-23

The proportion who are net beneficiaries has been rising steadily since the 1970s, but surged in Covid.

It has been gradually subsiding since but remains above the pre-pandemic level.

The ONS figures showed the median equivalised household income before taxes and benefits was £37,300 in 2022-23.

That increase to £39,700 once taxes and benefits were taken into account.

The richest fifth of households had an income on that measure of £114,300, 11.6 times larger than the £9,800 for the poorest fifth.

However, after all taxes and benefits were taken into account the average equivalised final incomes for the richest fifth was £82,200, 3.4 times as much as the £24,500 for the poorest fifth.

The figures also underlined the scale of the pain Brits have been facing from the cost of living crisis.

After all taxes and benefits and allowing for inflation, there was a 4.7 per cent decrease in median equivalised final income compared to the previous financial year.

Including the 85.3 per cent who had retired, 52.6 per cent were in households that received more than they contributed