Labour’s pensions IHT raid could see some families hand a staggering 67% of leftover pension to HMRC from April 2027, in a brutal double death tax raid.

First, the pension company will hand 40% of the pot directly to HMRC on death. Then, if the policyholder died age 75 or over, beneficiaries will pay income tax on withdrawals too.

A 40% higher rate taxpayer would face a total tax charge of 64%, leaving them with just £36,000 of a £100,000 inherited pension.

An additional rate 45% rate taxpayer would pay tax at a crazy 67%, leaving them with just £27,000.

The good news is there is plenty they can do to fight back. Options include withdrawing pension and spending it while alive or gifting it to loved ones.

There’s another one that many may not have thought about. Use some of your pension to buy an annuity.

An annuity is a lifetime guaranteed income that people buy with their pension pot. Buying one was obligatory before 2015’s pension freedom reforms.

Sale slumped afterwards, as pensioners rebelled against annuities. They offered poor value after the Bank of England slashed interest rates almost to zero following the 2008 financial crisis.

In 2015, for example, a single 65-year old who used a £100,000 pension to buy a level annuity got income of less than £5,000 a year.

Today, most retirees leave their pension invested in the stock market via drawdown, and take money as required. Now they may want to rethink.

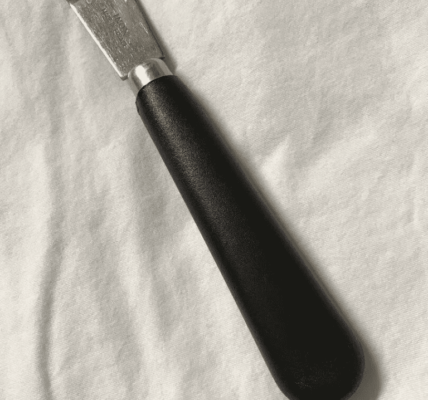

The income from an annuity stops when you die so there is no inheritance tax to pay (Image: Getty)

Today’s higher interest rates make annuities look much better value and £100,000 would buy a single 65-year-old a level income of more than £7,000 a year for life.

Annuity sales jumped almost 40% in the 2023/24 tax year to 80,061 as a result, according to the Financial Conduct Authority. That’s the highest figure in a decade.

Pensions specialist William Burrows at The Annuity Project said sales may climb again as families sidestep Reeves’ IHT raid on defined contribution pensions.

A big attraction of drawdown is that people can pass on unused funds to family on death, he said. “Once Reeves removes this, people with pensions big enough to fall into the IHT trap may consider an annuity instead.”

Annuities have another advantage, Burrows said. “They pay out more than the prudent amount that can be taken from drawdown.”

Someone aged 65 with £100,000 can get £7,200 from a level single life annuity. If they took income via drawdown instead, most advisers would urge them to only take 4% a year, know as the “safe withdrawal rate”.

That would limit them to income of £4,000 a year initially. Although that could rise in future years depending on their investment returns.

Annuities are attractive because they pay a guaranteed income for life, no matter how long you live, with no investment risk or danger of default.

The income from a single life annuity stops on death, so won’t count towards the total value of your estate when calculating IHT.

Joint life annuities may become more popular because when they policyholder dies they continue to pay 50% of the income to a spouse or partner for life, Burrows said.

That also stops on death so again, there’s no IHT to pay.

Savers don’t have to use all their pension to buy an annuity. They could just use a chunk of it.

They could leave the reminder in drawdown to grow, while making sure it’s not big enough to attract IHT.

It’s a complicated decision so consider financial advice and shop around for the best annuity rate if you do buy one. Reeves won’t like it but your family will thank you.