The Prime Minister and top politicians have been urged to pay tax on clothing donations worth tens of thousands of pounds.

Revelations that Sir Keir Starmer received clothing worth more than £32,000 from Labour peer Lord Alli have rocked the party.

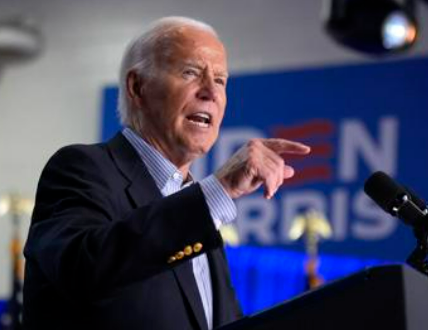

The Prime Minister received clothing donations worth more than £32,000 (Image: Getty)

Pressure is mounting for the law to be tightened so such donations are classed as taxable income.

Former Defence Secretary Sir Gavin Williamson has written to the Chancellor – whom it is reported received £7,500 for outfits from a friend before Labour took power – asking whether the clothes are considered a “taxable benefit in kind”.

He said: “Keir Starmer and those who have received those gifts need to be totally transparent.”

A frustrated Labour MP said it demonstrated a “breathtaking level of naivety that he took this clothing in the first place”.

They said: “If this had been a Tory prime minister, he and his Chancellor would have been the first to call for an investigation.”

Claire Aston, director of the charity TaxWatch, pushed for politicians to pay tax on gifts.

She said: “It’s especially important for politicians to declare and pay taxes on any gifts received and the law should be clarified to ensure there is consistency of treatment and to avoid confusion.”

The Government is confident no tax is owed but the furore overshadowed Labour’s first conference as a party of power in a decade in a half.

Sir Keir has repaid £6,000 worth of hospitality and gifts he received since becoming Prime Minister.

Last month it was reported that the PM, the Chancellor and Deputy Prime Minister Angela Rayner, who received £3,550 in clothes from Lord Alli, would no longer accept clothing donations.

Lord Alli provided hospitality for Labour 23 times in the run-up to the election. Last week it was revealed the Lords’ standards watchdog is investigating whether he has properly registered his own interests.

Matt Crawford, a partner with accountancy firm Blick Rothenberg made the case for a change in the law on taxing donations to politicians.

He said: “I don’t think anybody has done anything wrong. They have followed the law.

“I just don’t think the law is very sensible.”

He suggested that “any form of gift that’s even tangentially related to your professional activities” should be taxable but with a “sensible threshold” in place.

“It would be a perfectly sensible thing to do, to change the law going forward to say that political gift or indeed any gift that is related to or connected with your employment of office is subject to tax,” he said. “It would be a very easy rule change.”

Sir Gavin backed a reform of the rules, saying that the PM had received “tens of thousands of pounds in gifts that most people would have to pay for out of their hard-earned taxed income” and it is the “right thing for them to look at paying that tax and changing those rules”.

A spokesman for an accountancy firm which wished to remain anonymous said that if clothing donations were classed as a “benefit in kind” then “the value of the gift would be taxable as employment income on the employee or office holder at the recipient’s marginal tax rate and national insurance can apply”.

David Portman, a tax partner with chartered accountants Lubbock Fine, said the tax status of gifts is “ambiguous” because “the donor could argue they making the gift out of friendship and not related to their job”.

He added: “Some might argue that the rules require changing to make this clearer for political gifts.”

An HMRC spokeswoman said: “We’re committed to ensuring everyone pays the right tax under the law, regardless of wealth or status.”