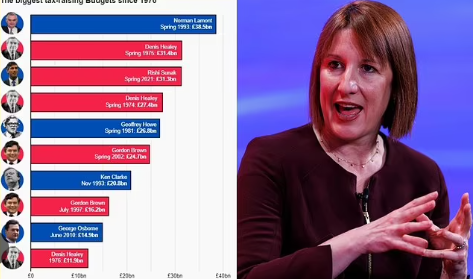

Rachel Reeves could hammer Brits with biggest tax-raising Budget EVER: Chancellor’s ‘£40bn’ package hitting NICs, CGT and inheritance tax might top Rishi Sunak’s 2021 misery and Lamont’s 1993 mega-raid_Nhy

Rachel Reeves could hammer Brits with one of the biggest tax-raising Budgets ever in a fortnight.

The Chancellor is preparing to unveil an eye-watering £40billion of tax hikes and spending cuts on October 30.

Tax is likely to make up the overwhelming bulk of the package – expected to include increases to national insurance, capital gains and inheritance tax. That could mean it exceeds the £31.3billion brought in by Rishi Sunak‘s post-Covid Budget in Spring 2021.

It might even be bigger than Norman Lamont’s 1993 mega-raid, which was worth around £38.5billion in current prices. That came in the aftermath of the Black Wednesday sterling crisis.

Anxiety is growing over the scale of Ms Reeves’ plans after she dropped heavy hints about looming ‘pain’ and pushing up NICs for employers.

Several senior ministers including Angela Rayner are said to have voiced concerns at a political Cabinet session on Tuesday about proposals to trim some departments’ spending.

Chancellor Rachel Reeves is preparing to unveil an eye-watering £40billion of tax hikes and spending cuts on October 30

Ms Reeves told the meeting that plans to fill what she has branded a ‘£22billion black hole’ in the UK’s finances will be enough only to ‘keep public services standing still’. Since taking power Labour has handed public sector workers a series of major pay rises to settle industrial disputes.

The Treasury is said to have identified a far larger £40billion funding gap which Ms Reeves will seek to plug to protect key departments from real-terms cuts and put the economy on a firmer footing.

Touring broadcast studios this morning, Education Secretary Bridget Phillipson said that ministers were having to ‘make some really tough choices’.

Asked about the reported backlash over cuts to departmental spending, she told Times Radio ‘we’ve got to fix the problems that we’ve inherited’.

She insisted there will be ‘no return to austerity’ and added: ‘We do, all of us have to make some really tough choices because of the inheritance (…) given to us by the Conservatives.’

She pointed to the issues with prisons overcrowding and accused the former prime minister Rishi Sunak of not being ‘prepared to confront that difficult choice’.

The Education Secretary added: ‘We’ve got to fix the problems that we’ve inherited but we want to make sure that we’re delivering on the commitments that we made, making sure that there are more jobs, more opportunities, a growing economy.’

Both the Chancellor and the Prime Minister have insisted a rise in NICs for employers would not break Labour’s manifesto pledge to support ‘working people’, as it would not be a direct tax on employees.

But the Institute of Directors, which represents 20,000 bosses, said the Government’s argument was ‘false’.

It likened the policy to Lady Thatcher’s hated poll tax on individuals, which led to riots in 1990 and brought down her premiership. And it warned the impacts will be ‘borne by workers’, hitting jobs and wages.

According to the OBR watchdog’s database of tax measures – which goes back to 1970 – Lamont’s first Budget in 1993 brought in the equivalent of £38.5billion.

A further fiscal package that year raised another £20.8billion.

Mr Sunak’s Spring 2021 Budget increased revenues by a net £31.1billion in the aftermath of Covid.

Another raid later that year bolstered Treasury coffers by nearly £18billion.

The May 1974 Budget was also a huge boost for Exchequer, bringing in £27.2billion.

The 2023 Autumn Statement and 2024 Spring Budget under Mr Sunak’s premiership cut the burden by around £26billion.

Keir Starmer looks to be facing a revolt from ministers over trimming spending

Experts have argued that ministers need to find £20 billion to avoid a squeeze on so-called ‘unprotected’ departments pencilled in by their Tory predecessors, and billions more to prevent a sharp fall in investment spending.

Some of that could come from changing the measure the Government uses to calculate debt, but economists from the Institute for Fiscal Studies have suggested that some tax rises are all but inevitable to prevent cuts to day-to-day spending.

Downing Street has denied that Sir Keir gave the public the wrong impression about the scale of tax rises that would come under Labour.

Asked whether the Prime Minister had misled voters, his press secretary said: ‘No. So we stand by our commitments in the manifesto, which was fully funded.

‘We were honest with the British public, both during the election and since, about the scale of the challenge that we would receive.

‘Then, of course, one of the first things the Chancellor did when we came in was do an audit of the books and found a £22 billion black hole that the previous government lied about and covered up.

‘So that’s why we have continued to be honest with the British people that there are going to be difficult decisions in this Budget, and that’s because of the mess that the Conservatives left the economy in.’