What are the chances of Rachel Reeves hitting YOUR wallet at the Budget? National insurance, capital gains and inheritance all in the crosshairs as ‘tax bomb’ looms_Nhy

Brits are bracing for grim news on Wednesday as Rachel Reeves mounts one of the biggest tax raids in history.

The Chancellor is expected to add around £35billion a year to the burden, saying she needs to plug a ‘black hole’ in the finances and pump money into public services.

Keir Starmer delivered a stark warning this morning that people must face the ‘harsh reality’ of handing more to the state.

Labour has committed to holding the main rates of income tax, national insurance and VAT – although controversially employer NICs are seen as fair game.

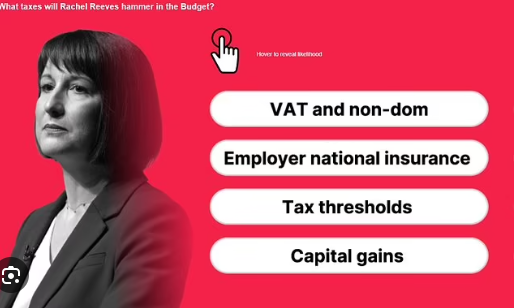

Here are some of the key hikes being mulled by ministers, with the likelihoods they will actually go ahead.

VAT on private school fees and non-dom crackdown – likelihood 10/10

The Labour manifesto committed to scrapping non-dom status, adding VAT to private school fees and increasing stamp duty on buyers from abroad.

The party estimated the VAT move would bring in £1.5billion by 2028, while the other tweaks were projected to bring in billions more together with a vague squeeze on ‘tax avoidance’.

However, questions have been raised about the revenue predictions, with warnings that wealthy people will simply leave the country.

Employer national insurance – 9/10

Rachel Reeves looks almost certain to increase employer NICs, despite claims it is a ‘straightforward breach’ of the Labour manifesto.

The Chancellor now seems to be leaning towards hiking the main rate and lowering the threshold when it starts being paid, rather than imposing the levy on contributions made to pensions for the first time.

The measures could raise up to £20billion a year.

There had been alarm from Labour big beasts about a more direct raid on pension pots, with fears firms would be unable to compensate for the extra charges, and retirement funds would simply end up smaller.

Sir Keir and Ms Reeves are facing a pivotal moment in the Labour government at the Budget

NICs is charged at different rates for employers, employees and the self-employed

Tax thresholds – 8/10

Tax thresholds have been frozen since 2021, and are due to stay so until 2028.

Jeremy Hunt also decided to reduce the top rate mark from £150,000 to £125,000.

The OBR has estimated that the policy will bring 3.8million more people into the tax system through ‘fiscal drag’ – where incomes rise to account for inflation but tax thresholds stay the same in cash terms.

Some 2.7million more are expected to pay the higher 40p rate, and 600,000 extra the 45p top rate.

The OBR projected that the Government’s tax revenues will be boosted by an enormous £41billion a year as a result.

However, there are claims that Ms Reeves is set to extend the freeze again. That would give her an additional £7billion in the final year of the fiscal forecast – when the books have to be balanced.

Capital gains – 8/10

Ms Reeves could hit profits on sales of shares and other assets, which currently face a 20 per cent levy – or 10 per cent when people sell businesses.

Labour appears to have backed off big moves on the headline rate, or second properties.

HMRC estimates that a one percentage point increase in the higher rate of capital gains tax would raise just £100million.

But a 10 percentage point increase or more – as has been mooted in some quarters – could actually cut revenue because so many investors would take action such as delaying sales or quitting the UK.

The IFS has suggested that attacking business asset disposal relief (BAD) – a preferential CGT rate for business owners – could bring in £1.5billion.

So-called ‘uplift at death’ could also be in the crosshairs. It means that assets such as businesses owned when someone dies are valued for tax purposes from the date when they were acquired, rather than at the date of death.

The asset is, however, inherited at current value. Getting rid of that benefit could bring in £1.6billion.

Inheritance tax – 7/10

IHT is charged at 40 per cent on estates worth over £325,000, but that level can rise to £1million for a couple passing property to children.

Abolishing that loophole could potentially raise £2billion a year.

Pension pots – 7/10

Think-tanks have floated cutting the amount people can draw out of pensions tax-free from £286,275 to £100,000.

Such a change would raise around £2billion a year.

It would affect about one in five retirees.

People could also be restricted from passing on pension pots to relatives.

Retirement savings are treated generously by the taxman when people die at present, especially if that is before age 75.

They have therefore become widely used in inheritance tax planning, and are often spent last if at all.

Options open to the Government include making pension assets liable for inheritance tax, and levying a charge on them at death.

Pension and tax experts predict a crackdown would lead to a rise in gifting, and perhaps greater use of trusts and insurance products.

Share dividends – 6/10

The dividend allowance means the first £500 received by an investor in a year is tax-free.

But Ms Reeves could opt to scrap that relief, arguing that investments held in an ISA or pension are tax-free anyway and ‘working people’ do not have the resources to contribute to both.

ISAs – 6/10

Some years ago Ms Reeves called for a £500,000 lifetime allowance on how much can be held tax-free in ISAs.

The Resolution Foundation has suggested the figure could be even lower at £100,000.

Ms Reeves has also hinted that the annual £20,000 ceiling on contributions is too high, as only the wealthier benefit.